CFIB continue to advocate for small and medium sized enterprises

A new report from the Canadian Federation of Independent Business (CFIB) says small businesses in Ontario are paying far more in taxes than similar outfits in the United States.

According to the report, a small business with 25 employees in Ontario pays on average 24 per cent more in taxes than an American counterpart. Micro businesses with four employees face a 15 per cent higher tax load.

Angela Drennan, CFIB’s vice president of legislative affairs in Ontario, said regulatory costs and taxes are some of the biggest challenges for small and medium-sized firms.

She pointed to three top cost constraints businesses are facing.

Drennan said CFIB has also been lobbying to raise the tax deduction threshold.

She added that raising Ontario’s Employer Health Tax threshold similarly to provinces like Newfoundland and Manitoba, could save the average small business nearly $16,000 a year.

Drennan emphasized that CFIB is also pushing to reduce Ontario’s small business tax rate.

The organization says action is needed to keep Ontario competitive with U.S. states and help businesses grow.

More information on the report is available at CFIB.ca.

Story by: Evan Gibb

Judge raises serious concerns in Brockville lawyer trust case as firm responds

Judge raises serious concerns in Brockville lawyer trust case as firm responds

Brockville General Hospital attracts top U.K. doctors in major recruitment push

Brockville General Hospital attracts top U.K. doctors in major recruitment push

Ontario funding boost promises faster CT scans at Brockville General Hospital

Ontario funding boost promises faster CT scans at Brockville General Hospital

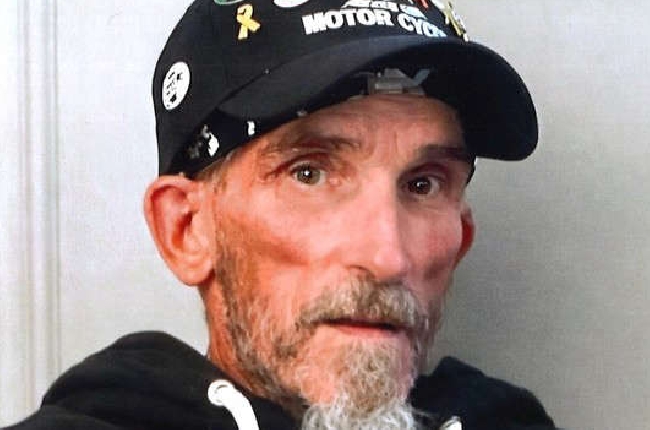

Brockville mourns loss of beloved Legion volunteer who gave 21 years to community

Brockville mourns loss of beloved Legion volunteer who gave 21 years to community

Brockville Legion remembers beloved member whose kindness touched generations

Brockville Legion remembers beloved member whose kindness touched generations